- Home

- Igen payroll

- Payroll categories

- Superannuation

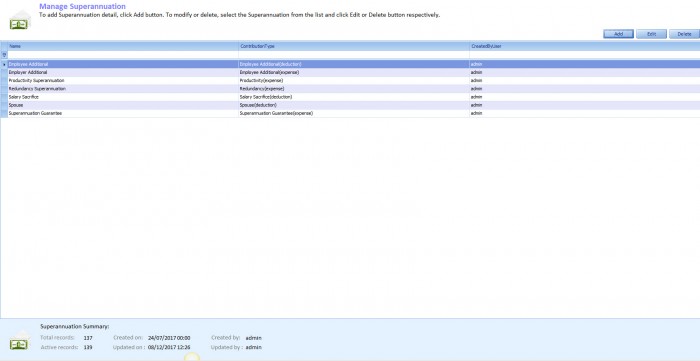

Regular contributions by employees towards a future pension are listed below, if needed user can add new superannuation to this list.

Linked Expense Account: Select the account type to link the expense for the employee.

Linked Payable Account: Select the account type to link the liability for the employee.

Calculation Basis: Allows calculating the employee contribution by following ways:

User entered amount: Enter the payment amount while processing employee pay

Percentage: Percentage of selected wages categories from the list. For example, 10 % of base gross wages (1250.00) is 125.

Dollar: Calculate amount from defined amount based on the selected period. For example 100 $ per month, If employee pay frequency is twice a month then 50 $ processed while paying.

Exclusions: Only applicable for percentage type, it excludes entered amount from the selected wages categories. For example, Gross wages is 1250 and exclusion amount entered is 500, then superannuation will be applicable for 750 (1250 – 500) only.

Limits:

No Limits: Set no limit for calculating superannuation.

Percentage: Set limit as a percentage of selected wages categories.

Dollar: Set limit as a fixed amount based on the selected period

Threshold: Enter the threshold amount for the month, if the amount exceeds the set value then only superannuation applicable to the employee.

For example, if the value is 4000 and monthly wages for an employee is 3500 then superannuation is not applicable for that employee.